As parents, we bear the immense responsibility of preparing our children not just for the challenges of today, but also for a future that may be vastly different from our own. One of the most crucial aspects of this preparation is ensuring they are set up for financial success.

This goes beyond merely providing for their needs; it involves teaching them the skills and knowledge to manage their finances effectively throughout their lives.

In a recent episode of the *Financial Advisors Say The Darndest Things* podcast, hosted by A.B. Ridgeway—a Certified Private Wealth Advisor professional with over a decade of experience—the topic of parenting and finance was explored in depth. Ridgeway provided actionable insights for parents who want to combine their faith and financial wisdom to create a secure and prosperous future for their children. Here’s a comprehensive guide based on that discussion.

The Power of Early Financial Education: Why Start Now?

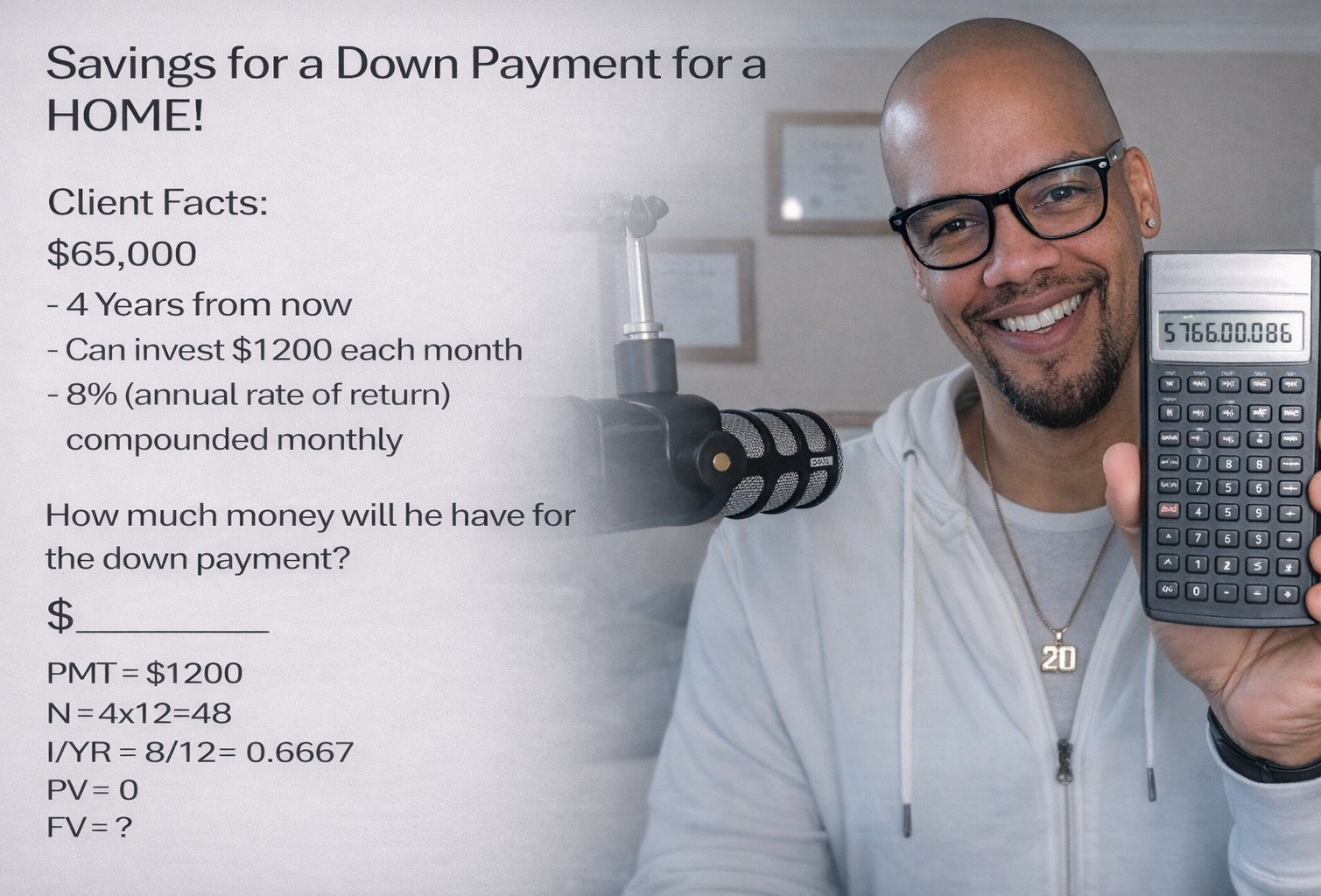

One of the most powerful financial tools at your disposal is time. The earlier you start planning and investing for your child’s future, the more time you have to leverage the power of compound interest—a phenomenon where the earnings on your investments generate even more earnings over time. Ridgeway emphasized that if you begin investing when your child is as young as two years old, they could potentially have 16 years of financial growth by the time they reach 18. If they continue on this path, they could see another 20 years of growth by the time they reach 40.

This long-term planning can significantly reduce financial stress for both you and your child. Imagine them entering adulthood with a solid financial foundation—a nest egg that can support their educational goals, entrepreneurial dreams, or even early retirement.

Join our Newsletter and receive our free 19-page e-book “4 Financial Principles Every Christian Should Know”

Click Here To Get Your Free Gift

Establishing an Educational Fund: The 529 Plan Explained

One of the first steps in setting up your child for financial success is to establish an educational fund. The cost of education is skyrocketing. Ridgeway cited a staggering statistic: between 1980 and 2020, the average price of tuition, fees, and room and board for an undergraduate degree increased by 169%. This dramatic increase shows no signs of slowing down, making it imperative for parents to plan ahead.

A 529 plan is one of the most effective tools available to parents. This tax-advantaged savings account is specifically designed for education expenses. Contributions to a 529 plan grow tax-free, and withdrawals are also tax-free as long as they are used for qualified education expenses, which can include tuition, books, and even room and board.

But what happens if your child doesn’t use all the funds in the 529 plan? Recent changes have made these accounts even more flexible. Unused funds can now be converted into a Roth IRA, which is a retirement account that also grows tax-free. This conversion allows parents to repurpose the savings without incurring penalties, provided the 529 plan has been open for at least 15 years and the amount converted does not exceed $35,000. This option ensures that your hard-earned savings continue to work for your child’s future, even if they choose a path other than college.

The Importance of a Will: Securing Your Child’s Financial Future

While it may seem premature to think about a will when your child is still in diapers, it’s actually one of the most critical steps you can take to protect their financial future. A will ensures that your assets are distributed according to your wishes, and more importantly, that your child is financially secure if something unexpected happens to you.

Without a will, the distribution of your assets could be left up to state laws, which may not align with your intentions. Additionally, if your child is underage, a will allows you to appoint a guardian to manage their inheritance until they reach the age of majority, which is 18 in most states.

Ridgeway highlighted the importance of not just having a will, but also educating your child on financial management. Imagine your child inheriting a substantial amount of money at 18 without any prior experience in managing finances. The risk of mismanaging the funds or falling prey to financial predators is high. By teaching them money management skills early on, you can ensure they are prepared to handle their inheritance responsibly.

Teaching Money Management: A Lifelong Skill That Pays Dividends

Financial education is not a subject taught extensively in schools, which is why it falls on parents to instill these crucial life skills in their children. Ridgeway shared a personal anecdote about how he introduced his own children to the world of finance. He took them to a local bank and helped them open their first debit card accounts, where they could learn about spending, saving, and earning interest in a controlled environment.

This hands-on approach to financial education is invaluable. It allows children to make small mistakes and learn from them without the risk of significant financial loss. For example, when Ridgeway’s children received cash for chores, they quickly learned the importance of not misplacing money—a $10 bill can easily disappear, but money in a bank account is safe and trackable.

In addition to managing their own money, Ridgeway taught his children the value of earning money through work. By linking chores and other responsibilities to financial rewards, he instilled a sense of work ethic and the understanding that money is earned, not simply given. This approach helps to prevent the sense of entitlement that can develop when children receive money without having to work for it.

Strategies for Financial Education at Different Ages

Teaching financial management is not a one-time lesson; it’s a continuous process that evolves as your child grows. Here are some age-appropriate strategies to consider:

1. **Toddlers (Ages 2-4):** At this stage, focus on basic concepts like the difference between wants and needs. Use simple language to explain that money is used to buy things, and that some things are more important than others.

2. **Early Childhood (Ages 5-7):** Introduce the idea of saving. Use a clear jar to demonstrate how saving money over time allows them to buy something they really want. This visual representation helps children understand the value of patience and delayed gratification.

3. **Middle Childhood (Ages 8-12):** At this age, children can start earning money through chores or small jobs. Open a savings account in their name and teach them how to track their balance. Introduce the concept of interest and how their money can grow over time.

4. **Teenagers (Ages 13-18):** As your child enters their teenage years, it’s time to discuss more complex financial concepts, such as budgeting, investing, and credit. Consider giving them a debit card linked to their account, with the understanding that they must manage their spending within the limits of their budget. Discuss the importance of building credit and the potential pitfalls of debt.

5. **Young Adults (Ages 18+):** Once your child reaches adulthood, encourage them to take an active role in their financial future. Help them set up a Roth IRA or contribute to a 401(k) if they have a job. Discuss the importance of maintaining an emergency fund and the benefits of long-term investing.

Avoiding Common Financial Pitfalls

Part of teaching financial management is helping your child avoid common mistakes that can have long-lasting consequences. Ridgeway emphasized the importance of learning from the mistakes of others rather than making them yourself. This is particularly true in the realm of finance, where one bad decision can lead to years of financial hardship.

For example, many young adults fall into the trap of accumulating credit card debt without fully understanding the implications of high interest rates. Teaching your child to use credit responsibly—only spending what they can afford to pay off each month—can save them from the stress and financial burden of debt.

Another common pitfall is failing to plan for the future. Encourage your child to think beyond their immediate wants and needs, and to consider their long-term goals. Whether it’s buying a home, starting a business, or retiring early, having a financial plan in place is key to achieving these dreams.

Empowering Your Child for a Financially Secure Future

Setting your child up for financial success is one of the greatest gifts you can give them. It’s not just about the money you save or the accounts you open—it’s about the lessons you teach and the values you instill. By starting early, leveraging tools like 529 plans, setting up a will, and providing hands-on financial education, you can empower your child to navigate the complexities of personal finance with confidence.

As Ridgeway wisely noted, “The less mistakes they make, the better.” By guiding your child through the process of managing money, you are helping them avoid costly errors and setting them on a path to financial independence.

So start the conversation today. The earlier you begin, the better prepared your child will be to face the financial challenges and opportunities that lie ahead. And remember, financial education is a journey, not a destination. Keep the dialogue open, encourage questions, and continue to provide guidance as your child grows and their financial needs evolve.

—

*If you found this article helpful, don’t forget to like, comment, and share! We would love to hear your thoughts on what strategies you’re using to set your children up for financial success. Let us know in the comments!*

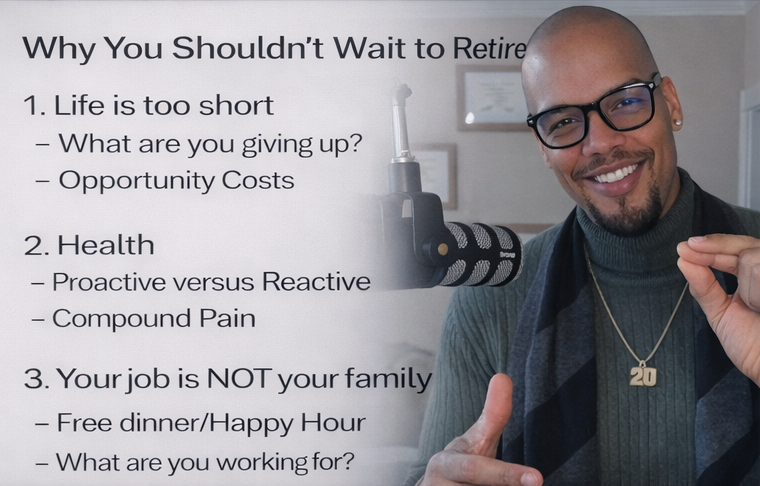

In this episode of “Financial Advisors Say the Darnedest Things,” A.B. Ridgeway, your trusted Christian financial advisor, delves into the crucial topic of setting up children for financial success. A.B. answers a listener’s question about how to best prepare a 2-year-old for future expenses like education. He emphasizes the importance of starting early, utilizing 529 plans for education savings, and teaching children essential money management skills.

- Utilize 529 Plans for Education Savings: A 529 plan is an excellent tool for saving for your child’s education. It offers tax advantages and flexibility, covering expenses from kindergarten through graduate school. Recent changes allow unused funds to be converted into a Roth IRA, ensuring that your savings continue to benefit your child even if they don’t pursue traditional education paths.

- Establish a Will for Financial Security: Creating a will ensures your child’s financial security in the event of unforeseen circumstances. Designating a guardian to manage finances until they reach adulthood prevents potential legal complications and provides clear instructions on how your assets should be distributed, safeguarding your child’s future.

- Teach Money Management Skills Early: Introducing your child to banking with a child account can instill valuable money management skills. By earning, saving, and spending responsibly, children learn the importance of financial stewardship. Encouraging them to work for their money through chores fosters a sense of responsibility and diminishes entitlement.

- Focus on Financial Education, Not Just Wealth Accumulation: The key to financial success is not merely accumulating wealth but learning to manage it wisely. By educating your children on avoiding common financial mistakes and making informed decisions, you equip them with the tools to navigate the financial landscape confidently and independently.

Quotes:

- “The earlier you start, the less stress you’ll have around money and its growth.”

- “A 529 plan is a powerful tool for securing your child’s educational future.”

- “It’s not about how much money they have; it’s about how they manage it.”

Click Here To Start Your 529 Plan

About Financial Advisors Say The Darndest Things Podcast:

As Christians, we were taught to be good stewards over our tithing and giving to the less fortunate. But when it came to our personal finances and investing we were left clueless on what the Bible says. What does the Bible say about managing debt, leaving a legacy, investing, and planning for your retirement? Mr. Christian Finance answers these and many other questions because we want to teach you how to become rich and righteous!

Meet A.B. Ridgeway:

A.B. Ridgeway, MBA, CPWA®️ (info@abrwealthmanagement.com) is the owner and Christian Financial Advisor with A.B. Ridgeway Wealth Management. With a decade in the finance industry, his goal is to give believers clarity around the most confusing topic in the Bible, money, and tithing. A.B. Ridgeway helps tithing Christians become cheerful givers but unlocking their money-making potential, so they can prosper and be the great stewards of the wealth God has entrusted them with.

*Disclaimer: This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. This is strictly for information purposes. We recommend you speak with a professional financial advisor.