The world of college funding is ever-evolving. Whether you have adult children, young children, or are a student yourself, the concern of paying for higher education is always looming. But there is some great news for those looking to fund education: The Department of Education has introduced new rules for the Free Application for Federal Student Aid (FAFSA) that might just make things easier.

Specifically, there’s a new “grandparent loophole” that makes 529 plans more attractive than ever before.

Let’s dive into what these changes mean for you and your family.

- What’s New with 529 Plans?

- Key Changes to 529 Plans in 2024

- 529 Plan Contribution Limits

- The Importance of Investing Your 529 Contributions

- The Role of Financial Advisors in 529 Plans

- The New 529 Tax-Free “Grandparent Loophole” for College Savings (Podcast)

What’s New with 529 Plans?

529 plans have long been a go-to choice for parents saving for their children’s college education. However, traditional 529 plans had some major drawbacks. If your child opted not to go to college, the money you saved could be taxed heavily upon withdrawal, leading to much anxiety and frustration for many parents. But there’s good news: Starting in 2024, the government is introducing key changes to make these plans more flexible.

Key Changes to 529 Plans in 2024

Rollover to Roth IRA: Up to $35,000 of unused savings in a 529 plan can be rolled over tax-free into a Roth Individual Retirement Account (IRA). This new feature eliminates the fear of unused money being trapped or taxed heavily.

If the child doesn’t go to college or drops out, the funds can be redirected into their retirement savings.

Also, early saving for retirement could mean easier financial planning in the long term.

Grandparent Loophole: Traditionally, when grandparents or other non-parents contributed to a 529 plan, the withdrawals could reduce financial aid eligibility by up to 50% of the distribution amount. With the new rule, any contribution from non-parents will not negatively affect the student’s financial aid eligibility. This means you can save more without worrying about diminishing financial aid.

“This new flexibility is a game-changer for families looking to support their children’s education without worrying about financial aid penalties.”

529 Plan Contribution Limits

In 2024, there are specific gifting limits to keep in mind:

Annual Gifting Limit: $18,000 for an individual and $36,000 for a married couple per beneficiary.

Accelerated Gifting: You can give up to five years’ worth of contributions in a single lump sum. For individuals, this amounts to $90,000, and for married couples, it’s $180,000.

These contributions are not tax-deductible, but they do receive preferential tax treatment upon distribution.

The Importance of Investing Your 529 Contributions

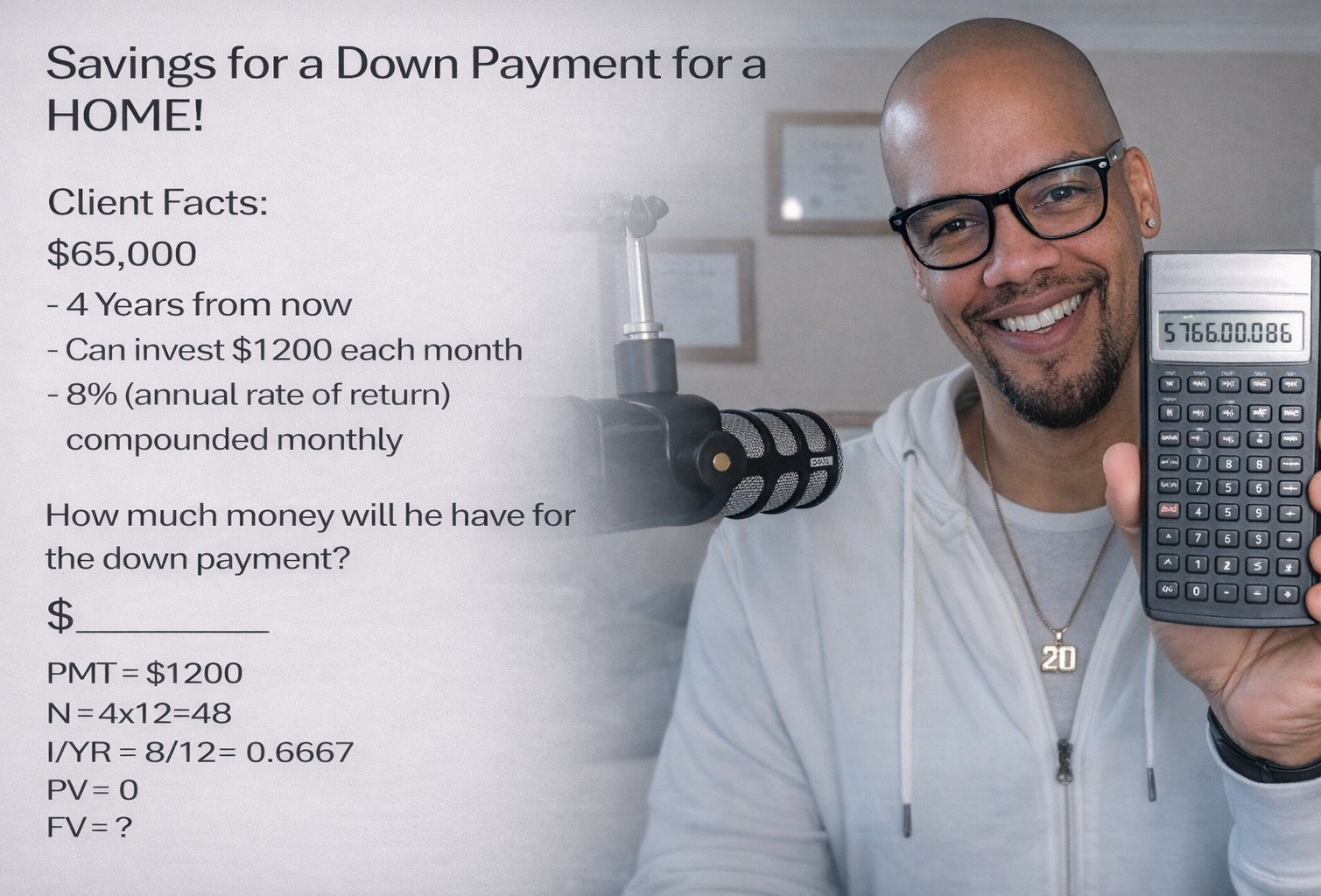

A significant point often overlooked is the importance of investing the money in your 529 plan. Simply putting cash into the plan without investing it will yield minimal growth. It’s essential to invest in assets to see notable returns.

Here’s a common scenario:

A parent puts $289,000 into a 529 plan over 18 years but only sees a slight increase to $293,000. This minimal return is often due to the funds being placed in cash or cash equivalent holdings rather than growth-oriented investments.

(this example is for illustrative purposes only)

The Role of Financial Advisors in 529 Plans

Many people mistakenly believe that just opening the right account type will automatically yield returns. The truth is that investing is key to growth. Consulting with a financial advisor can help ensure that:

Your money is invested wisely and your portfolio is diversified to balance risk and growth.

“You’re only going to get rewarded for the risk that you take. Putting something in cash is not really risky, so you’re not going to get the return that you may be expecting.”

Why College Is Still A Good Option

The Bigger Picture: College Education and Personal Development

There’s a broader perspective to consider beyond just financial savings. In recent times, companies like Google and other tech giants have lessened the need for college degrees for high-paying jobs. This shift raises questions about the value of college education:

Character Development: College offers more than just job skills. Subjects like art, literature, and philosophy contribute to personal growth and critical thinking.

Social Skills: College experiences contribute to developing social skills and a well-rounded personality.

With the landscape of education shifting, it’s important to weigh the benefits of a college education in terms of personal development, not just employability.

Embracing Flexibility with Faith and 529 Planning

These updates to the 529 plan represent significant improvements that offer more flexibility and peace of mind for families. The ability to roll over funds into a Roth IRA provides a safety net for those unpredictable moments in life.

Remember, financial planning, including college funding, should be part of your broader financial strategy.

Hebrews 11:6– And without faith it is impossible to please him, for whoever would draw near to God must believe that he exists and that he rewards those who seek him.

Need More?

The New 529 Tax-Free “Grandparent Loophole” for College Savings (Podcast)

Don’t miss this enlightening episode where A.B. Ridgeway breaks down the latest changes to 529 plans and how they can significantly impact your family’s financial planning for higher education.

Whether you’re a parent, grandparent, or a concerned relative, understanding these new rules can help you make smarter, more flexible decisions for your loved ones’ educational futures.

Ridgeway provides valuable insights into maximizing contributions, leveraging tax benefits, and integrating spiritual principles with financial planning.

Tune in to gain a comprehensive understanding of 529 plans and be prepared to navigate the evolving landscape of education funding with confidence. Listen now and secure a brighter future for the next generation!

In this comprehensive episode of “Financial Advisors Say the Darndest Things,” host A.B. Ridgeway explores the significant updates to the 529 education savings plans and their impact on families planning for higher education expenses.

Ridgeway delves into the new grandparent loophole, which provides greater flexibility for contributions from non-parents, ensuring that these funds do not adversely affect financial aid eligibility.

He also highlights the importance of investing contributions within the 529 plans to maximize growth and secure a robust financial future for beneficiaries.

The discussion extends to the broader implications of these changes, emphasizing the critical role of education in personal and societal development, as well as the integration of financial planning with spiritual growth.

Key Takeaways:

- 529 Plan Enhancements: Recent legislative changes allow up to $35,000 of unused savings in 529 plans to be rolled over tax-free into Roth IRAs. This provision ensures that leftover funds can still benefit the beneficiary’s financial future, eliminating fears of money being trapped or incurring significant taxes.

- Grandparent Loophole: Traditionally, 529 plan distributions from non-parents, such as grandparents, could reduce a student’s financial aid eligibility by up to 50% of the distribution amount. The new rules eliminate this penalty, making it easier for grandparents and other non-parents to contribute to a child’s education without negatively affecting their financial aid.

- Flexibility for Non-Parent Contributions: The grandparent loophole applies to any individual who is not a parent, including aunts, uncles, family friends, and other relatives. This expanded flexibility encourages a wider network of support for the beneficiary’s education, ensuring more significant contributions without financial aid repercussions.

- Investment Strategies in 529 Plans: It’s essential not just to contribute to 529 plans but to invest those contributions wisely. Simply holding cash in the account won’t yield the growth needed to keep up with rising education costs. Investing in diverse assets within the 529 plan can significantly enhance the fund’s value over time.

- Tax Benefits of 529 Plans: Contributions to 529 plans grow tax-free, and withdrawals used for qualified education expenses are also tax-free. This tax advantage makes 529 plans a highly effective savings vehicle for future education costs, maximizing the value of every dollar contributed.

- 529 Plans for K-12 Education: In addition to college expenses, 529 plans can now be used for up to $10,000 per year in K-12 tuition. This extension provides greater flexibility for families seeking to fund private or specialized education for younger children.

- 529 Plans and Student Loan Repayment: Recent updates allow 529 plan funds to be used to repay up to $10,000 in student loans. This provision offers a valuable option for graduates seeking to reduce their debt burden while benefiting from the tax advantages of 529 plans.

- Societal Impact of Education: The episode touches on a societal shift where high-paying jobs no longer necessarily require a college degree, thanks to companies like Google. However, Ridgeway emphasizes the value of a well-rounded education in developing personal character and social skills, which are vital for long-term success and fulfillment.

- Spiritual and Financial Stewardship: Ridgeway underscores the importance of integrating financial planning with spiritual growth. By using tools like the 529 plan and understanding the biblical principles of stewardship, individuals can better prepare for their financial futures while also nurturing their personal and spiritual development.

- Future-Proofing Education Savings: With the ever-changing landscape of education and employment, it’s crucial to stay informed about updates to savings plans like the 529. These plans offer adaptable, tax-advantaged solutions for securing the educational and financial future of the next generation.

Show Quotes:

- “The 529 education savings plans got a couple of big upgrades in 2024 as a better way to save and pay for school. Starting this year, Congress is allowing up to $35,000 of leftover savings in the plan to roll over tax-free into Roth IRAs, which will eliminate fears of unused money being forever trapped or incurring taxes.”

- “The grandparent loophole applies to all individuals who are non-parents, so it could be an auntie, it could be an uncle, it could be a family member or friend. The new rule ensures that regardless of the source of the cash, it will not negatively affect your eligibility for financial aid.”

- “I think we’re not developing people as human beings. Things like art, literature, and philosophy build character and help you think outside the box. It’s important to get into the Bible because personal development comes from God, transforming ourselves through the scriptures to become better people and better citizens.”

- “By investing the contributions in your 529 plan, you can significantly enhance the value of your savings, ensuring they grow to meet the future educational expenses of your beneficiary.”

- “The new rules surrounding 529 plans not only provide greater flexibility and tax advantages but also encourage a broader community of support, enabling more family members to contribute without jeopardizing financial aid.”

- “Integrating financial planning with spiritual growth allows individuals to prepare not just for their financial futures but also to nurture their personal and spiritual development, aligning with the principles of stewardship.”

How To Start 529 Planning

If you’re interested in setting up a 529 plan or need guidance on college planning, consider consulting with a financial advisor.

At A.B. Ridgeway Wealth Management, we specialize in helping families plan for the future.

Schedule a consultation today to take advantage of the “grandparent loophole” and set your family up for success.

Visit A.B. Ridgeway Wealth Management for more information and resources.

Click Here To Start Your 529 Plan

Join our Newsletter and receive our free 19-page e-book “4 Financial Principles Every Christian Should Know”

Click Here To Get Your Free Gift

About Financial Advisors Say The Darndest Things Podcast:

As Christians, we were taught to be good stewards over our tithing and giving to the less fortunate. But when it came to our personal finances and investing we were left clueless on what the Bible says. What does the Bible say about managing debt, leaving a legacy, investing, and planning for your retirement? Mr. Christian Finance answers these and many other questions because we want to teach you how to become rich and righteous!

Meet A.B. Ridgeway:

A.B. Ridgeway, MBA, CPWA®️ (info@abrwealthmanagement.com) is the owner and Christian Financial Advisor with A.B. Ridgeway Wealth Management. With a decade in the finance industry, his goal is to give believers clarity around the most confusing topic in the Bible, money, and tithing. A.B. Ridgeway helps tithing Christians become cheerful givers but unlocking their money-making potential, so they can prosper and be the great stewards of the wealth God has entrusted them with.

*Disclaimer: This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. This is strictly for information purposes. We recommend you speak with a professional financial advisor.